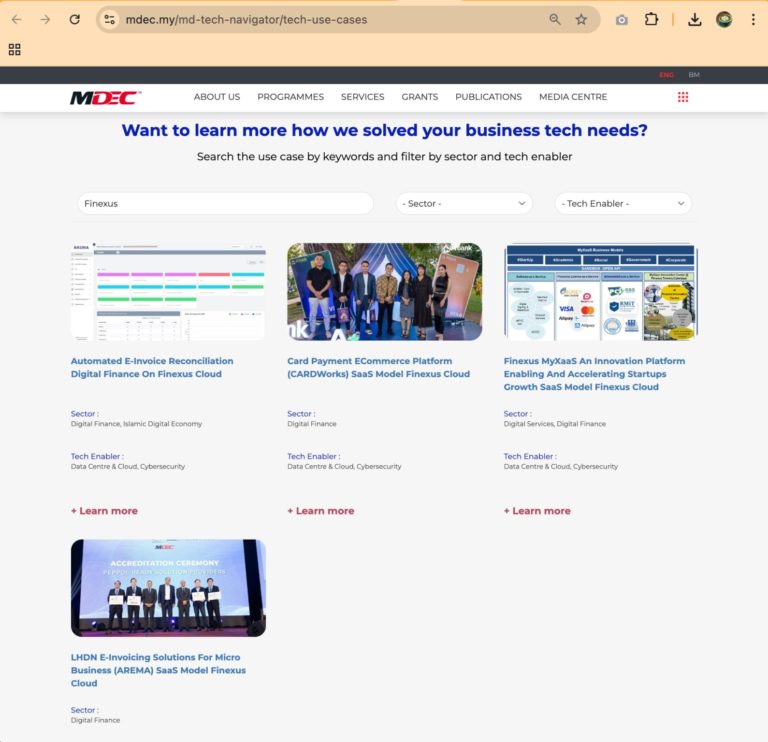

Kumpulan Syarikat FINEXUS

Kumpulan syarikat perkhidmatan teknologi dan kewangan terkemuka yang menhubungkan dan menawarkan perkhidmatan untuk para pengguna, perniagaan, bank dan bank pusat.

Dengan solusi dan perkhidmatan teknologi kami, kami berharap untuk membantu memperbaiki kehidupan harian golongan tanpa akses bank dan para penghijrah di komuniti tempatan kami melalui rangkuman kewangan dan juga membolehkan pelanggan / rakan korporat kami di seluruh dunia untuk berbuat demikian untuk komuniti mereka sendiri.