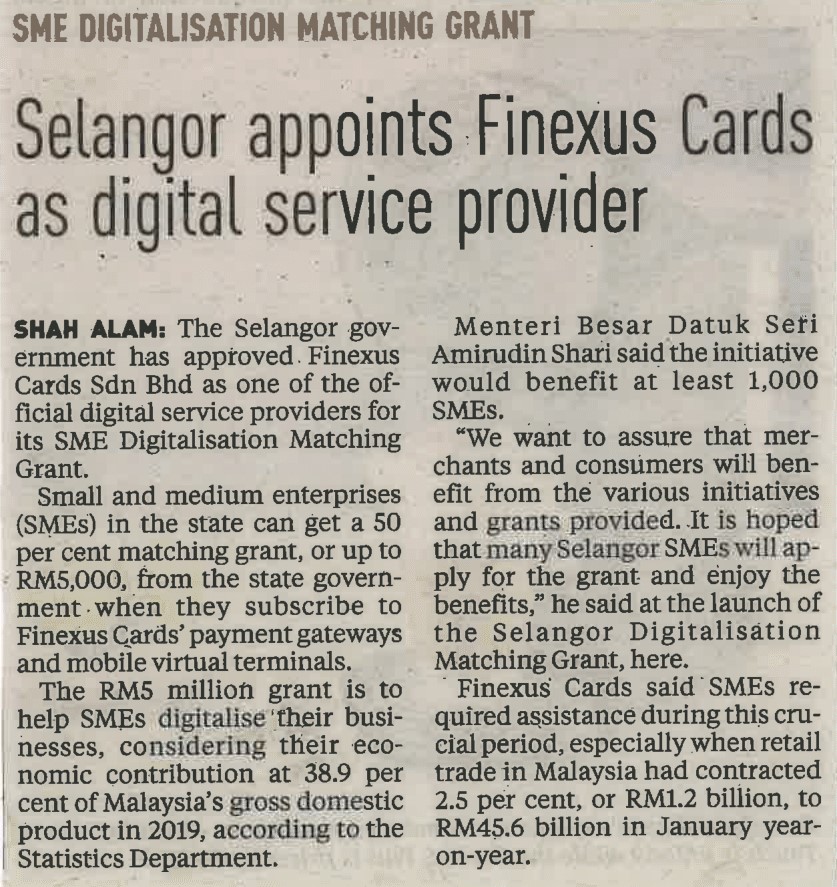

KUALA LUMPUR: The Selangor state government has approved Finexus Cards Sdn Bhd as one of the official digital service providers for its SME Digitalisation Matching Grant.

Under this grant, small medium enterprises (SMEs) in Selangor can receive a 50 per cent matching grant or up to RM5,000 from the Selangor government when they choose to subscribe to Finexus Cards’ payment gateways and mobile virtual terminals.

The grant, which worth a total of RM5 million, is to help Selangor SMEs to digitalise their businesses, considering its significant economic contribution at 38.9 per cent of Malaysia’s gross domestic product in 2019, according to the Department of Statistics Malaysia.

Selangor Menteri Besar Datuk Seri Amirudin Shari said the initiative was expected to benefit at least 1,000 SMEs in Selangor.

“SMEs that lack resources to digitalise their businesses are invited to apply for this grant to strengthen the digital reach of their businesses. The Selangor state government has always been committed in the digitalisation agenda to help the digitalisation of SMEs.

“We want to assure that merchants and consumers will benefit from the various initiatives and grants provided. It is hoped that many Selangor SMEs will apply for the grant and enjoy the benefits,” he said at the launching ceremony of Selangor Digitalisation Matching Grant in Shah Alam.

Finexus Cards said SMEs required assistance during this crucial period especially when retail trade in Malaysia had contracted 2.5 per cent or RM1.2 billion to register RM45.6 billion in January 2021 year-on-year.

This was due to the decrease in sales of non-essential goods, according to the Malaysian Economic Statistics Review (MESR) Volume 3/2021.

Retail trade not in stores, stalls or markets showed the strongest growth at 9.0 per cent, according to the report, demonstrating a possible increase of e-commerce activity.

Between March 1 and October 31 last year, a total of 373,213 entities registered their business under the online category with the Companies Commission of Malaysia, evidence of traction in e-commerce adoption.

Finexus group chief executive officer Clement Loh said the checking out process was a paramount experience for any online shoppers.

This inadvertently affects the whole shopping experience, and ultimately conversion and a returning customer.

“That is why we aspire to help SMEs of all sizes, from a home-based business owner to a medium-sized SME, in streamlining their payment process into an effortless, even enjoyable, experience for their patrons,” he said.

Payment gateways are suitable for SMEs who want to augment a stronger brand presence via an online storefront or marketplace.

Usually, they are suitable for SMEs that host or sell a large variety of products or services.

Finexus Cards thereby offers an easy, secure merchant plug-in that can be integrated with its payment gateway.

This allows SMEs’ customers to make online payments using credit cards and debit cards, as well as their e-wallets by scanning the generated DuitNow QR Code.

Its payment gateway also includes features such as pre-authorisation of payments, recurring payments and tokenisation.

Finexus Cards said SMEs can experience a user acceptance testing stage first before launching their payment gateway for verification and customisation.

Mobile virtual terminal (MVT), on the other hand, is made for microenterprises, basically individuals or home-based business owners with no shopping carts.

Many typically sell on social media such as Facebook, Instagram and Telegram, and receive payments using bank transfer, which can be cumbersome with higher likelihood of mistakes.

With MVT however, merchants only need to log into the Finexus Cards online merchant portal and send their customers a generated, unique secure payment link.

This link allows customers to then authorise payment via an OTP at their convenience, which directly notifies merchants of a successful payment instead of duly waiting for a digital receipt.

Finexus Cards is an e-money institution licenced by Bank Negara Malaysia to provide digital payment services.

The campany is also a principal member of PayNet DuitNow, Visa, Mastercard, Alipay and CCB LongPay.

Print: